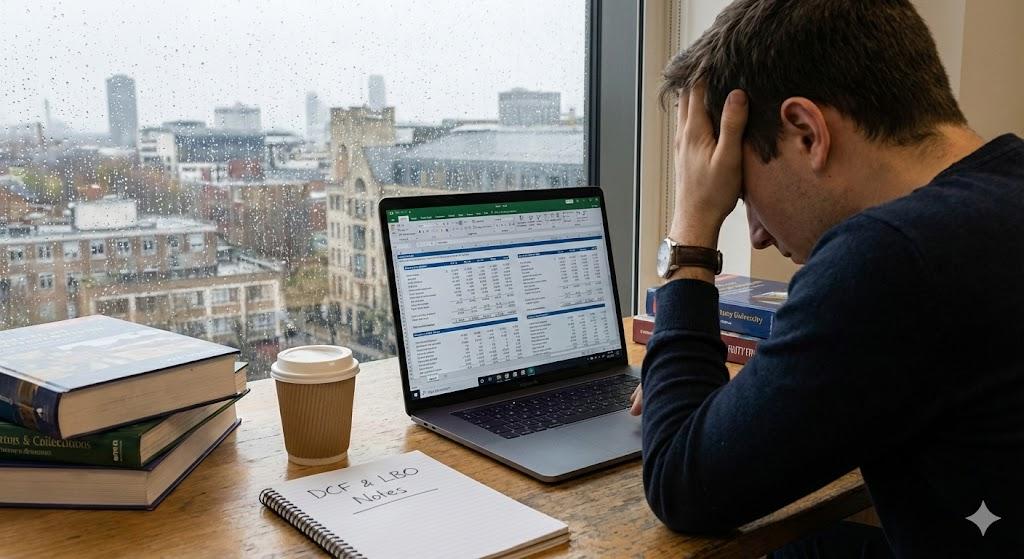

I remember the exact moment the panic set in for a student of mine—let’s call him James. It was late November, the sky outside my office window was that oppressive shade of London grey, and James was staring at his laptop as if it were a bomb about to detonate.

"I understand the theory," he said, his voice tight. "I know what a balance sheet is. But getting these three sheets to talk to each other without breaking the circularity reference? It’s impossible."

James wasn't failing because he lacked intelligence. He was drowning because he was treating financial modelling as a math problem, rather than a storytelling exercise.

If you are reading this, chances are you’ve felt that same specific brand of nausea. You’re looking at a blank Excel spreadsheet, the cursor blinking mockingly, knowing that a single misplaced formula can tank your entire valuation.

Here is the hard truth I’ve learned over fifteen years of mentoring students through LSE, Warwick, and Imperial: Recruiters in the City don't care if you can recite the definition of EBITDA. They care if you can build a model that reflects reality.

Let’s strip away the textbook jargon. Here are the models that actually matter, and exactly how you need to approach them to survive your degree and land the job.

The Nervous System: The Three-Statement Model

Most students try to build the Income Statement, Balance Sheet, and Cash Flow Statement in isolation. This is a fatal error. It is like trying to build a car by assembling the engine, the chassis, and the wheels in three different rooms and hoping they fit together later.

They won't.

The Three-Statement Model is the nervous system of finance. It connects everything. If you pinch the nerve in the Income Statement (say, by lowering revenue), the pain should immediately be felt in the Balance Sheet (lower cash) and the Cash Flow Statement (lower operating cash flow).

How to master it without losing your mind:

-

Respect the Flow: Memorise the linkages. Net Income flows into Retained Earnings. Depreciation flows from the Income Statement, gets added back on the Cash Flow Statement, and reduces PP&E on the Balance Sheet. If you miss one link, the model breaks.

-

The "Plug" is Your Friend: You need a "plug" figure—usually the Cash account on the Balance Sheet—to make the equation $Assets = Liabilities + Equity$ hold true. If your balance sheet balances on the first try, check again. You probably made a mistake.

-

Hard-code Blue, Calculate Black: This is standard industry etiquette. Hard-code your assumptions in blue font; keep formulas in black. It stops you from overwriting your own logic when you’re tired.

The Storyteller: Discounted Cash Flow (DCF)

This is the big one. The DCF is the bread and butter of investment banking. I’ve seen countless assignments where a student produces a mathematically perfect DCF that receives a failing grade. Why?

Because the assumptions were garbage.

A DCF relies on the core concept that money today is worth more than money in the future, expressed as:

But here is the catch: You can make a DCF justify any stock price if you manipulate the inputs enough.

The Veteran Approach:

-

Defend Your WACC: The Weighted Average Cost of Capital ($r$ in the equation above) is your discount rate. Don't just pull a beta of 1.2 out of thin air because Yahoo Finance said so. Why is it 1.2? Is the company more volatile than the market? If you can’t justify your discount rate, your valuation is a fantasy.

-

The Terminal Value Trap: Roughly 60-70% of a company’s value in a DCF often comes from the Terminal Value (what the company is worth after the projection period). If your long-term growth rate assumption is higher than the country's GDP growth, you are effectively saying this company will eventually become bigger than the entire economy. Do not be that student.

Escaping the Writer’s Block of Excel

Let’s pause for a second.

Reading about these models is one thing. Building them when you have three other deadlines, a part-time job, and a looming exam week is another beast entirely. I see this burnout every year. You stare at the screen, paralysis sets in, and suddenly you’re three days behind.

Sometimes, the smartest move is to stop spinning your wheels. You need a structural reference—a blueprint to check your logic against. It is not about having the work done for you; it’s about having a professional standard to model your own work after.

If you are hitting a wall where the numbers just won't align, or you need a breakdown of where your logic is failing, it might be time to look for finance assignment help. Getting clarity on the structure often breaks the deadlock, allowing you to actually learn the material rather than just panic over it.

The Stress Test: Leveraged Buyout (LBO) Model

If the DCF is a storytelling exercise, the LBO model is a stress test. This is what Private Equity firms do: they buy a company using a massive amount of debt, fix it up, and sell it.

Think of an LBO like buying a house to rent out, but using a mortgage that costs 90% of the house's value. You need to know exactly—to the penny—if the rent (cash flow) will cover the mortgage payments (debt service).

Where students trip up:

-

The Debt Schedule: This is the heart of the LBO. You need to model different "tranches" of debt (Revolver, Term Loans, Senior Notes), each with different interest rates and repayment priorities. It is tedious, but it is where the grade is won or lost.

-

Exit Multiple: You need to assume what you can sell the company for in 5 years. A common mistake? Assuming you can sell it for a higher multiple than you bought it for. Unless you have a brilliant operational thesis, that is pure optimism, not finance.

The Reality Check: Comparable Company Analysis ("Comps")

Finally, we have Comps. This is relative valuation. It answers the question: "How much are people paying for other houses in this neighbourhood?"

It sounds easy. You just find an average P/E ratio and apply it, right?

Wrong.

The skill here is in the selection. If you are valuing a high-growth tech start-up in Shoreditch, you cannot compare it to a mature telecom giant just because they both "use the internet."

The Golden Rule of Comps:

You must scrub the financials. Companies hide things. One-time legal fees, restructuring costs, asset write-downs—these distort the earnings. If you use the raw Net Income from Google Finance without "normalising" the EBITDA, your multiples will be skewed, and your valuation will be laughable.

Moving From Academic to Professional

I want you to change how you look at these assignments.

Stop viewing them as hurdles to jump over to get your degree. These models are your vocabulary. In a year or two, when you are sitting in a glass-walled office in Canary Wharf at 11 PM, nobody is going to ask you to write an essay on the theoretical underpinnings of Modigliani-Miller.

They are going to ask you to fix a broken circular reference in an LBO model before the client meeting at 8 AM.

Mastering these models now is not just about grades. It is about confidence. It is about knowing that when the pressure is on, and the numbers are flying, you are the one in the room who can make sense of the chaos.

So, open that spreadsheet. Check your linkages. And if it doesn't balance? Take a breath. It’s all part of the process.