Market Overview:

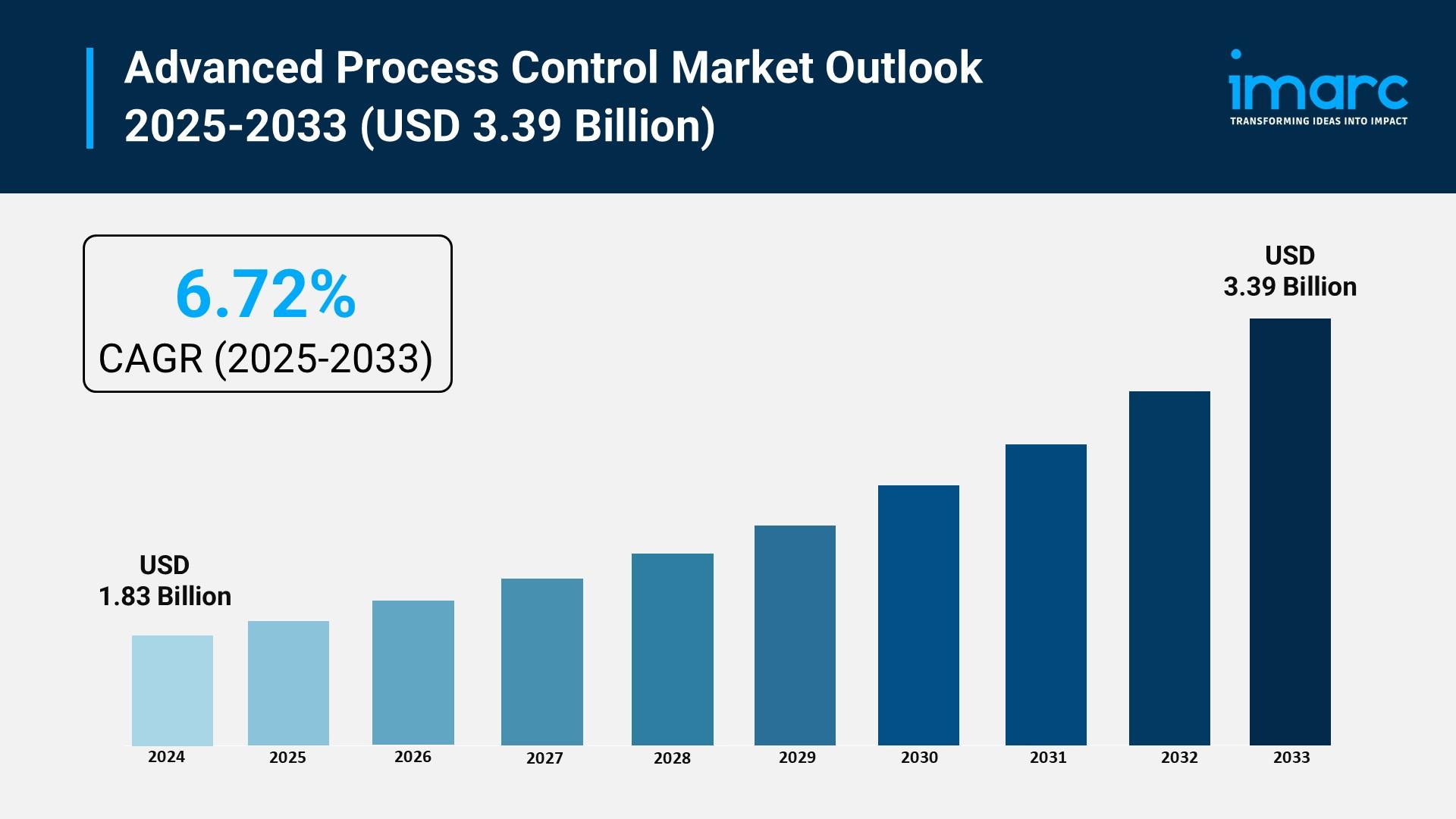

The advanced process control market is experiencing rapid growth, driven by increasing demand for operational efficiency and cost reduction, accelerated digital transformation and industry 4.0 adoption, and growing focus on energy efficiency and environmental compliance. According to IMARC Group’s latest research publication, “Advanced Process Control Market Size, Share, Trends and Forecast by Component, End Use Industry, and Region, 2025-2033”, The global advanced process control market size was valued at USD 1.83 Billion in 2024. The market is projected to reach USD 3.39 Billion by 2033, exhibiting a CAGR of 6.72% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/advanced-process-control-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Advanced Process Control Market

- Increasing Demand for Operational Efficiency and Cost Reduction

The imperative for industries to maximize output and minimize expenditures is a primary driver for the Advanced Process Control market. Companies across sectors like oil and gas, chemicals, and pharmaceuticals are under pressure to operate closer to process constraints without sacrificing safety. APC systems enable them to achieve this by stabilizing processes and minimizing fluctuations in key variables like temperature and pressure. For instance, in the oil and gas segment, which accounted for approximately 24.5% of the global APC market in 2024, APC solutions are critical for optimizing complex, continuous operations. Analysis indicates that companies implementing these systems have realized operational cost savings of up to 25%, demonstrating a clear return on investment that compels widespread adoption and fuels market expansion.

- Accelerated Digital Transformation and Industry 4.0 Adoption

The global shift towards digital manufacturing, encapsulated by the Industry 4.0 movement, is significantly boosting the deployment of Advanced Process Control technologies. This transformation involves integrating smart, connected technologies like the Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and Big Data analytics into traditional industrial processes. Reports indicate that over 70% of manufacturers are currently investing in Industry 4.0 initiatives, which inherently require sophisticated control systems to manage the surge of real-time data. This integration allows APC software—a segment that generated approximately 47.58% of the total market revenue in 2024—to perform real-time monitoring, predictive maintenance, and complex data analytics, transforming traditional operations into highly automated, data-driven environments.

- Growing Focus on Energy Efficiency and Environmental Compliance

Stricter environmental regulations and the rising cost of energy are increasingly driving industries to adopt APC solutions for sustainability goals. Advanced Process Control systems allow facilities, particularly those in energy-intensive sectors like power and chemicals, to optimize energy consumption by precisely controlling and adjusting process parameters in real-time, thereby ensuring minimal waste. A survey highlighted that 80% of stakeholders view regulatory compliance as a key motivator for adopting advanced control technologies. Furthermore, companies utilize APC to meet compliance standards related to emissions. For example, the Multivariable Model Predictive Control (MPC) technology, a leading segment in the market, is highly favored in refineries, with approximately 70% of refineries employing MPC to enhance process stability and reduce excess energy use, aligning both economic and environmental objectives.

Key Trends in the Advanced Process Control Market

- Integration of Artificial Intelligence and Machine Learning

A major emerging trend is the deeper integration of Artificial Intelligence (AI) and Machine Learning (ML) into Advanced Process Control systems, moving them beyond traditional model-based control. This integration allows APC systems to leverage massive datasets for advanced pattern recognition and anomaly detection that surpass the capabilities of conventional programming. This has a profound impact on maintenance strategies, enhancing predictive capabilities. Concrete examples show that companies using AI-driven APC solutions have achieved significant reductions in equipment downtime, in some cases by as much as 30%. Furthermore, AI algorithms are being used to automatically tune and update APC models, which previously required extensive manual effort from specialized engineers, thereby improving the sustainability and performance of the control applications over time.

- Rise of Cloud-Based and Edge APC Solutions

The market is witnessing a decisive shift toward cloud-based and hybrid deployment models, in contrast to the traditional reliance on entirely on-premises systems. While on-premises installations still accounted for roughly 71% of the market spending in a recent year, cloud adoption is scaling rapidly, driven by the appeal of reduced capital expenditure and enhanced scalability. This trend is particularly relevant for small and medium-sized enterprises, which are now able to access high-performance APC capabilities previously only viable for large corporations. New offerings include "plug-and-play" cloud APC solutions that are easier to deploy and integrate with existing Distributed Control Systems (DCS). Moreover, edge computing is being utilized to perform real-time control loops locally, while leveraging the cloud for advanced analytics and enterprise-wide optimization, making operations more flexible and resilient.

- Focus on Customized and Scalable Solutions for Niche Applications

Another significant trend is the development of highly customized and scalable APC solutions tailored to specific, often complex, niche industrial processes outside the dominant oil and gas sector. The pharmaceutical industry, for instance, is projected to be a major growth area, propelled by the strict need for product quality consistency and regulatory compliance in drug manufacturing. This sector demands specialized APC to manage batch processes and comply with Process Analytical Technology (PAT) initiatives. Furthermore, industries like food and beverage, as well as mining, minerals, and metals, are also increasing their APC adoption due to energy intensity and product consistency challenges. The shift sees companies offering modular APC components that can be customized to specific production lines, allowing for cost-effective deployment across a wider variety of process applications than ever before.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging advanced process control market trends.

Leading Companies Operating in the Global Advanced Process Control Industry:

- ABB Ltd.

- Aspen Technology Inc.

- Azbil Corporation

- Emerson Electric Co.

- FLSmidth & Co. A/S

- General Electric Company

- Honeywell International Inc.

- Onto Innovation

- Panasonic Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

Advanced Process Control Market Report Segmentation:

By Component:

- Software

- Service

Service accounts for the majority of shares on account of the critical role in ensuring effective deployment and functioning of advanced process control systems.

By End Use Industry:

- Oil and Gas

- Petrochemical

- Pharmaceutical

- Food and Beverage

- Energy and Power

- Chemical

- Others

Oil and gas holds 16.2% market share due to highly complex, continuous operations demanding precise control and optimization.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific enjoys the leading position with 36.9% market share owing to rapidly expanding industrial base and strong focus on automation across manufacturing sectors.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302